The European recovery plan, named Next Generation EU, was launched in the heart of the pandemic crisis that began in early 2020. This recovery plan truly represents a project of unprecedented scale in the European construction history. But the EU is a complex thing, difficult to grasp for the uninitiated as the institutional mechanism is so difficult to understand. This recovery plan can be a cornerstone for the future of the European, but can also become the painful indicator of the institutional dysfunctions of the EU.

1. Next Generation EU, what does it mean?

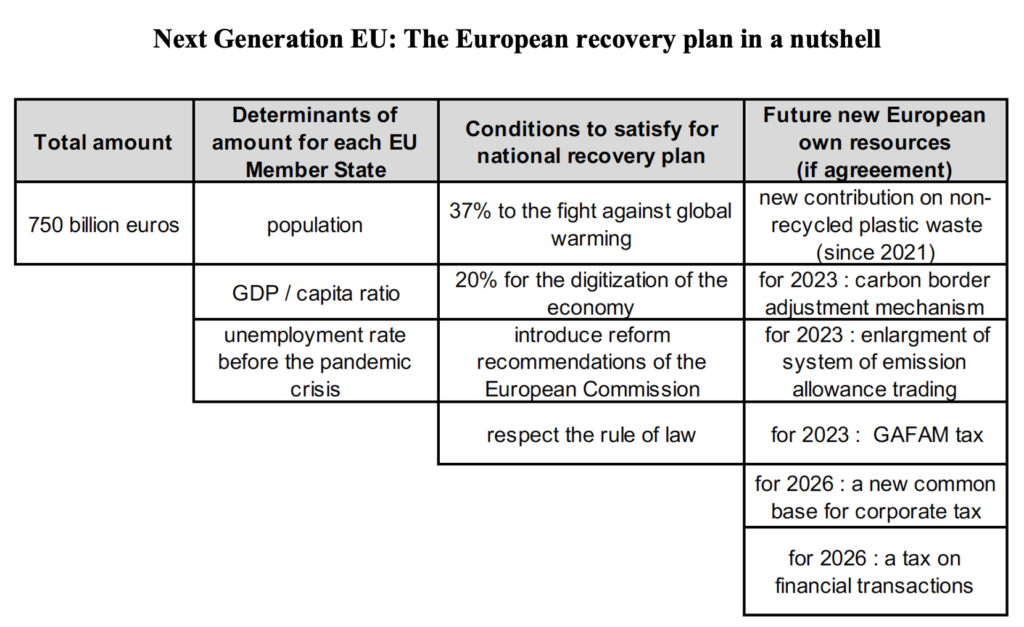

Next Generation EU is intended to finance the national recovery plans implemented by the 27 EU Member States to face the pandemic crisis. It takes the form a large European loan amounting to 750 billion euros. This is an unprecedented initiative in the history of the European construction, up to the challenges to be taken up following the pandemic crisis. This is the first time that the European Union (e.g. the European Commission) will go into debt for the member countries of the EU. This funding should make it possible to finance national fiscal policies between 2021 and 2027. Faced with an unprecedented situation, an unprecedented answer has been provided.

2. Will all EU countries benefit from it?

All EU countries will have access to this funding but under conditions. To benefit from this European loan, each country must implement a recovery plan that meets 4 conditions: (1) devote 37% of the recovery plan’s public spending to the fight against global warming, 2) earmark 20% for the digitization of the economy , 3) take into account the reform recommendations of the European Commission resulting from the European Semester, 4) respect the rule of law (particularly in terms of the fight against fraud or reform of the public procurement code). If these conditions are met, the amount that each country will benefit from is calculated according to the population, the GDP / capita ratio and the unemployment rate before the pandemic crisis (between 2015 and 2019).

3. To what extent will France benefit from this European recovery plan?

In France, the European loan will finance 40 billion euros of the 100 billion euros France Relance recovery plan. The French recovery plan, which proposes 70 measures, is based on 3 pillars: ecological transition, competitiveness and innovation, and social and territorial cohesion. The first payment is expected to take place in the summer of 2021 (the rest in 2023).

4. Why has the Next Generation EU money not yet reached the budget of the Member States?

For an unprecedented initiative, an unprecedented procedure is needed, which makes the process inevitably long and delicate. In addition, some countries have slowed down the procedure, explaining the delay in the adoption of the Next Generation EU by the European Council and then by the European Parliament. The frugal countries (Denmark, Sweden, Austria, the Netherlands) want many safeguards to be introduced to avoid abuses in national recovery plans. Countries like Hungary and Bulgaria oppose the condition on respect for the rule of law. Next Generation EU is now adopted. It’s done. There are still several steps to be taken before the funding actually reaches the national budget. Before being able to borrow on the financial markets, the national (and sometimes regional) Parliaments of the 27 must now give their agreement so that the Commission can borrow, in the name of the 27 countries. As long as they do not do so, the European recovery plan will remain purely theoretical. So far, rather less than a small half of the countries have allowed the Commission to go into debt. It is in progress. The last step is to validate each national recovery plan at the EU level, to check that they comply with the conditions to be met to benefit from the European loan. The European Commission will then be able to issue its first bonds in July 2021.

5. Who will pay?

These 750 billion euros will indeed have to be repaid one day! To repay this loan, the European Commission will dispose to new own resources and will begin to repay in 2028. It is still a long obstacle course that looms since the Member Countries will all have to agree. To date, only a new contribution on non-recycled plastic waste has seen the light of day since January 1, 2021. By 2023, three new own resources should appear via the carbon border adjustment mechanism, the revision of the system of emission allowance trading and a digital tax (more commonly known as the GAFAM tax). By 2026, two new own resources could be added via the new common base for corporate tax and a tax on financial transactions (also known as the Tobin tax or Robin Hood tax). The merit of these new own resources is that they do not weigh on consumers or firms, so as not to jeopardize the positive effects expected from the recovery plans.